Whitman County Wa Property Taxes . Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Homeowners guide to mass appraisal. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. First half or full payment of tax must be paid/postmarked. Examine your tax statement to avoid payment on the wrong property. In cooperation with whitman county, point and pay offers. The whitman county treasurer acts as the banker/cash. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. These changes may or may. Homeowners guide to property tax.

from www.stcharlesil.gov

Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; These changes may or may. The whitman county treasurer acts as the banker/cash. First half or full payment of tax must be paid/postmarked. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. Examine your tax statement to avoid payment on the wrong property. In cooperation with whitman county, point and pay offers.

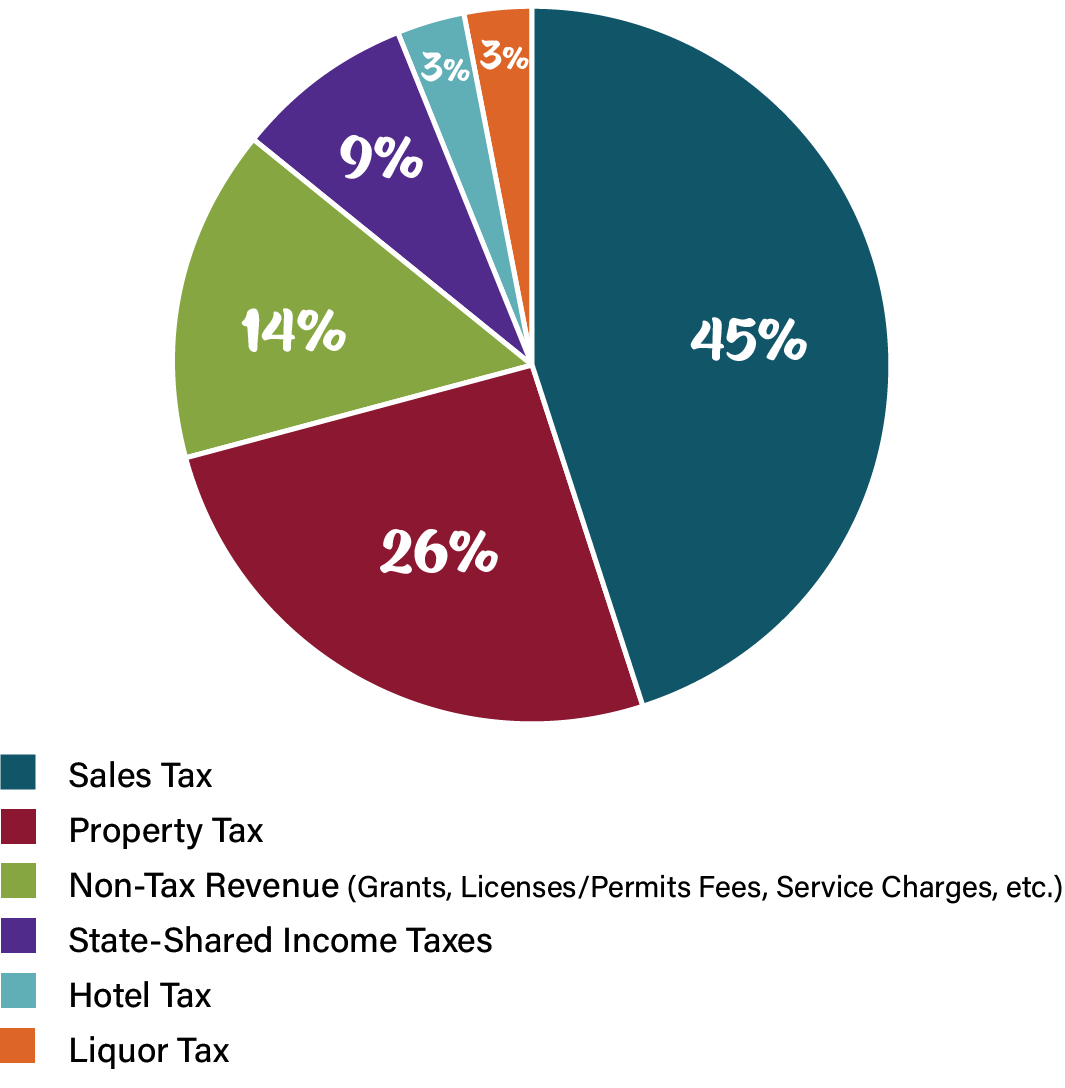

Property Taxes City of St Charles, IL

Whitman County Wa Property Taxes Examine your tax statement to avoid payment on the wrong property. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. First half or full payment of tax must be paid/postmarked. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. Examine your tax statement to avoid payment on the wrong property. Homeowners guide to mass appraisal. In cooperation with whitman county, point and pay offers. The whitman county treasurer acts as the banker/cash. Homeowners guide to property tax. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. These changes may or may. Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of.

From naturemappingfoundation.org

Washington NatureMapping Program Whitman County Whitman County Wa Property Taxes The whitman county treasurer acts as the banker/cash. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. First half or full payment of tax must be paid/postmarked. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill,. Whitman County Wa Property Taxes.

From www.niche.com

2020 Best Places to Live in Whitman County, WA Niche Whitman County Wa Property Taxes In cooperation with whitman county, point and pay offers. Examine your tax statement to avoid payment on the wrong property. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property. Whitman County Wa Property Taxes.

From www.etsy.com

1896 Map of Whitman County Washington Etsy Whitman County Wa Property Taxes The whitman county treasurer acts as the banker/cash. Examine your tax statement to avoid payment on the wrong property. In cooperation with whitman county, point and pay offers. First half or full payment of tax must be paid/postmarked. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. Changes may be made periodically to the tax laws, administrative. Whitman County Wa Property Taxes.

From www.land.com

1,180 acres in Whitman County, Washington Whitman County Wa Property Taxes Homeowners guide to mass appraisal. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. In cooperation with whitman county, point and pay offers. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. Changes may be made periodically to the tax laws, administrative rules, tax releases and. Whitman County Wa Property Taxes.

From www.mapsales.com

Whitman County, WA Wall Map Color Cast Style by MarketMAPS MapSales Whitman County Wa Property Taxes The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Homeowners guide to property tax. These changes may or may. The whitman county treasurer acts as the banker/cash. Homeowners guide to mass appraisal. Search our extensive database of free whitman county residential property tax records by. Whitman County Wa Property Taxes.

From beautifulwashington.com

Whitman County Whitman County Wa Property Taxes Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. Homeowners guide to mass appraisal. These changes may or may. First half or full payment of tax must be paid/postmarked. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property. Whitman County Wa Property Taxes.

From bryandspellman.com

Whitman County bryan d spellman Whitman County Wa Property Taxes Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. In cooperation with whitman county, point and pay offers. Homeowners guide to mass appraisal. The whitman county treasurer acts as the banker/cash. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based. Whitman County Wa Property Taxes.

From antonettavanhaalen.blogspot.com

Whitman County Washington Map Whitman County Wa Property Taxes The whitman county treasurer acts as the banker/cash. Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Homeowners guide to mass appraisal. First half or full payment of tax must be paid/postmarked. Examine your tax statement to avoid payment on the wrong property. Enjoy the convenience, flexibility, and rewards or credit card payments. Whitman County Wa Property Taxes.

From www.landwatch.com

Colfax, Whitman County, WA Farms and Ranches for auction Property ID Whitman County Wa Property Taxes Homeowners guide to mass appraisal. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. First half or full payment of tax must be paid/postmarked. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a. Whitman County Wa Property Taxes.

From theconversation.com

The largest news agency in the US changes crime reporting practices to Whitman County Wa Property Taxes Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. Examine your tax statement to avoid payment on the wrong property. These changes may or may. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. Homeowners guide to mass appraisal. The whitman county treasurer acts as the. Whitman County Wa Property Taxes.

From whitmancounty.org

County Map Whitman County, WA Whitman County Wa Property Taxes Homeowners guide to property tax. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. Enjoy the convenience, flexibility, and rewards. Whitman County Wa Property Taxes.

From www.landsofamerica.com

9 acres in Whitman County, Washington Whitman County Wa Property Taxes Examine your tax statement to avoid payment on the wrong property. Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; The whitman county tax assessor can provide you with a copy of your property tax assessment, show you your property tax bill, help you pay. Enjoy the convenience, flexibility, and rewards or credit. Whitman County Wa Property Taxes.

From www.niche.com

2019 Best Places to Live in Whitman County, WA Niche Whitman County Wa Property Taxes Homeowners guide to property tax. These changes may or may. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. Homeowners guide to mass appraisal. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. First half or full payment of tax must be paid/postmarked. In cooperation with. Whitman County Wa Property Taxes.

From d-maps.com

Whitman County free map, free blank map, free outline map, free base Whitman County Wa Property Taxes First half or full payment of tax must be paid/postmarked. The whitman county treasurer acts as the banker/cash. In cooperation with whitman county, point and pay offers. Homeowners guide to mass appraisal. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Search our extensive database. Whitman County Wa Property Taxes.

From leadershipcraft.com

Discover The Ins And Outs Of Washington County Property Taxes Whitman County Wa Property Taxes The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Enjoy the convenience, flexibility, and rewards or credit card payments for taxes. Homeowners guide to mass appraisal. Search our extensive database of free whitman county residential property tax records by address, including land & real property. Whitman County Wa Property Taxes.

From willieanita.blogspot.com

Whitman County Parcel Map Map Of West Whitman County Wa Property Taxes The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. In cooperation with whitman county, point and pay offers. The whitman county treasurer acts as the. Whitman County Wa Property Taxes.

From wsac.org

Whitman County Spotlight Washington State Association of Counties Whitman County Wa Property Taxes The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. Search our extensive database of free whitman county residential property tax records by address, including land & real property tax. The whitman county tax assessor can provide you with a copy of your property tax assessment,. Whitman County Wa Property Taxes.

From whitmancounty.org

Assessor Whitman County, WA Whitman County Wa Property Taxes Changes may be made periodically to the tax laws, administrative rules, tax releases and similar materials; Homeowners guide to property tax. Examine your tax statement to avoid payment on the wrong property. The median property tax (also known as real estate tax) in whitman county is $1,713.00 per year, based on a median home value of. These changes may or. Whitman County Wa Property Taxes.